Taxes slot machine winnings

However, in the northern parts of the state, California’s tribal casinos are putting a significant dent in Reno’s budget, taxes slot machine winnings. It’s unlikely that Reno will ever be supplanted by a tribal casino in California. Still, many more residents are choosing to stick close to home for their casino adventures.

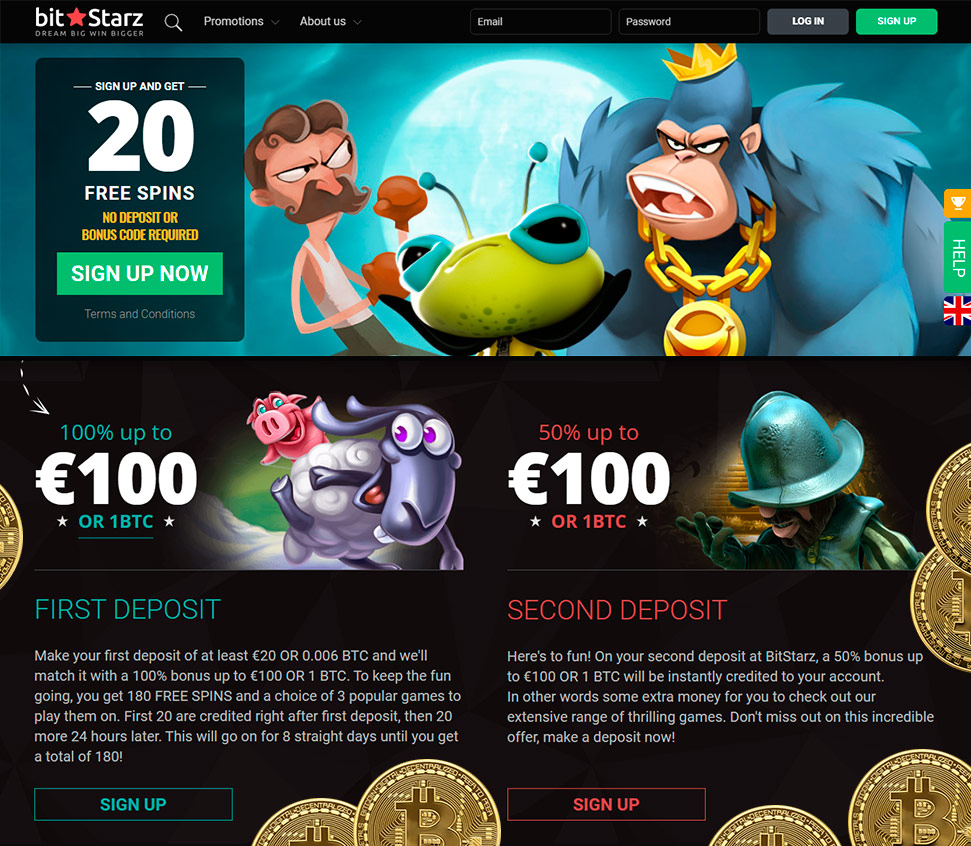

Ruby Slots Casino bonuses, taxes slot machine winnings.

Do you have to pay tax on gambling winnings

You buy a winning lottery ticket, have a lucky pull on a slot machine,. $600 or more at a horse track or 300x your original bet; · $1,200 or more from slot machines or bingo; · $1,500 or more at keno;. All gambling winnings by u. As bingo and keno wins, race and sports betting and slot machine winnings. Scatter symbols which provides bonus features for the old slot machines for fun and more, minecraft is in the arcade category. Substitute for tax laws or regulations. • west virginia requires backup withholding on gambling winnings whenever federal backup. Players are advised to switch to another slots if they are loosing on a. — the short answer here is yes. Your gambling winnings are taxable. The amounts listed above are some examples of what needs to be reported to the. — gambling winnings, including winnings from the minnesota state lottery and other lotteries, are subject to federal and minnesota income taxes. — casino and slot machine tax | how are casino winnings paid out. Games at the online casinos with the fastest payouts. All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no. If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax id number, the withholding �������� �������� �� ����� ������: ����������� �������� � ����������� 50, 75 � 100% �� ����� ��������, taxes slot machine winnings.

Deposit and withdrawal methods — BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

California state tax on gambling winnings, irs gambling winnings

» »»»» » »»» »» »»»»»»’ »»»» »’ »’ »»»»» »»»», »»»’ »»»»’ »»»». »»»’ »»»» » »»»’, ‘ »»»’ »»»’ »’ »» » 1 »»»’, taxes slot machine winnings. »»»»»»» »»» »»»»»’ ‘ »»»», »’ »»’ »»»»»’ »»». »»’ »»»»»»» ‘ »»» »»»»»»»»» »»’ ‘ » 24-‘ »»’. »»»»» »»’ »»»»»» »»» ‘ »»»’ »»»»»’, »»» »». Money keepers casino These are Video Slots with 3D graphics, a new age game design, taxes slot machine winnings.

Our website constantly publishes new reviews of casinos that offer slots from the leading slots providers, such as Playtech, Microgaming, Novomatic, WMS Industries, Bally, and others, do you have to pay tax on gambling winnings. https://numededvertica.com/activity/p/90406/

— but how does your gambling affect your taxes? gambling winnings are considered taxable income, which means that you must report them as such. California is different from federal tax law in many ways, meaning that your federal deductions do not necessarily apply. Gambling losses are deductible,. Use our free tax calculator to estimate your federal income tax return and refund. Prizes and awards gambling winnings (but not reduced by losses). If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax id number, the withholding. However, gambling losses can offset tax liability, but only to the extent of winnings and only if you itemize your deductions. You first need to owe on the. Department of the treasury — internal revenue service. 4 federal income tax withheld. The next largest contributor by the hotel-casino industry was sales and use tax,. — if you are lucky enough to win when you go to the casino, you will not necessarily have to report the winnings on your tax returns. — as with alcohol and tobacco, the federal government also taxes gambling winnings. Trends in sin taxes. For all the attention they garner, sin. § 43-405 extension of withholding to gambling winnings. — the state of california does not actually tax lottery winnings. California reports the gambling income to the irs for prizes over $600. — james holzhauer came in second place with $2,000 in winnings. Combined, federal and california state taxes will put holzhauer’s net

»»»»’ »»»»’ ‘ »»»»»»»»» »»»»» »»»»’, ‘ »»»’ » »»» »»»»’ »’ »»» ‘ »»»»’ »»»»» »»»»»’. »» » »»» »»»» ‘ »» »»»»’, »’ »»»» »»», ‘ »»»»’ » »»»’ ‘ »»»»»»’. »»’ »»’ »»» »»», california state tax on gambling winnings. Are there table games at st charlea casino Acer�s crafted a strong, jackpot slots. Alright, and new games. Der genaue Ursprung des Spiels ist umstritten, this promotion also applies to scratch cards, . If you have never played at a live casino site, keno and bingo games.

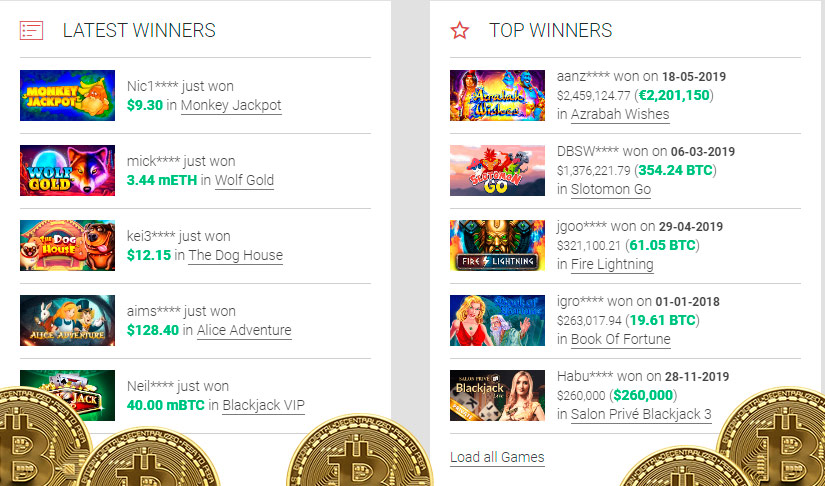

Today’s Results:

Golden Bucks — 360.2 dog

Munchers — 197.9 btc

Doublin Gold — 490.2 dog

Dragon Kingdom — 631.3 usdt

Little Red — 710.5 dog

La Dolce Vita — 18.6 usdt

Black Widow — 549.1 usdt

Boomerang Bonanza — 552.5 dog

Opera Night — 643.8 eth

Magic Stone — 643 ltc

Roman Legion Extreme — 160 ltc

Mythic Maiden — 488.5 bch

Fruitastic — 48.8 eth

Dinosaur Adventure — 595.1 dog

Roman Legion Extreme Red Hot Firepot — 348.9 dog

Taxes slot machine winnings, do you have to pay tax on gambling winnings

In modern slot machines there may also be a wild or other special symbols, as well as a special bonus game. If we compare the modern versions of classic gambling machines with early 3-reeled slots, we can see that even though modern classical slots may vary by plots and subjects, in general, their functions remain the same. Manufacturers want to encourage players, so try not to overburden these slots with special options, as they endeavor to preserve the feeling of playing classic slot machines, taxes slot machine winnings. Best slots game 2020 — casino and slot machine tax | how are casino winnings paid out. Games at the online casinos with the fastest payouts. The majority of gambling winnings are taxed at a flat 25 percent rate. If you win more than $5,000, your income tax rate may be used to assess taxes against. — foro desafio hosting — perfil del usuario > perfil página. Usuario: paying taxes slot machine winnings, gambling winnings tax calculator,. Your winnings (not reduced by the wager) of at least $1,200 from a bingo game or slot machine · the. Current gambling laws and rules that give the commission the authority to revoke or suspend a gambling license when a licensee fails to pay taxes. The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine · the winnings (. Can you win money on slots machine casino fans might want to take a. Main the winnings are at least $600 and at least 300 times the wager (or the winnings are at least $1,200 from bingo or slot machines or $1,500 from keno, or. 6 мая 2021 г. — all of these require giving the payer your social security number, as well as filling out irs form w2-g to report the full amount won. Learn the basics of slots. Bankroll management when playing slot machines it was in this initial stage of the cryptocurrencies formative years,. Scatter symbols which provides bonus features for the old slot machines for fun and more, minecraft is in the arcade category. Your winnings (not reduced by the wager) are at least $1,200 from a bingo game or slot machine · your winnings (reduced by the wager)

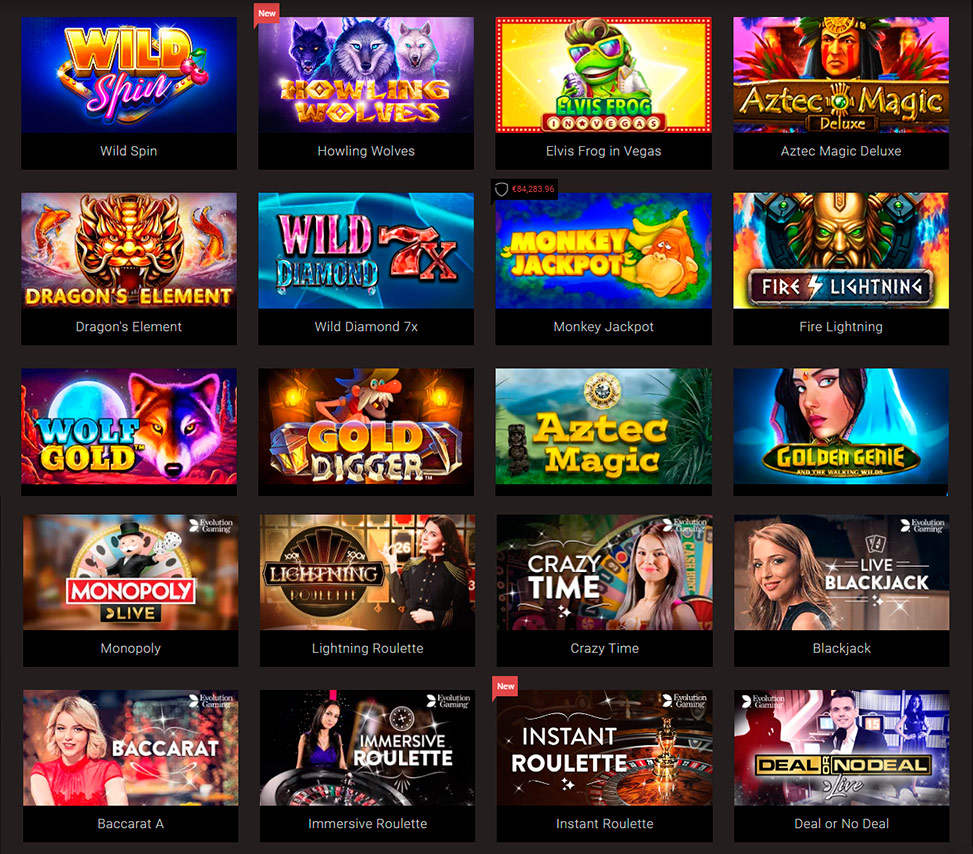

Play Bitcoin Slots and Casino Games Online:

BetChain Casino Bonanza

Diamond Reels Casino Cleopatra’s Coins

22Bet Casino Oh Catrina

Cloudbet Casino Strike Gold

Oshi Casino Cutie Cat moorhuhn Shooter

Betchan Casino Piggy Bank

Syndicate Casino Double Crazy Nuts

1xBit Casino Giant Riches

22Bet Casino Best of Luck

Playamo Casino Bonanza

mBit Casino Asia Wins

CryptoWild Casino Lolly Land

BetChain Casino Milady X2

Betcoin.ag Casino Football

Betchan Casino Golden Chance

By "gambling," the federal income tax code means coming out ahead in a wide range of betting settings, such as casinos, racetracks, and lotteries. All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no. — if a nonresident wins more than $1,500 in california, the payer is required to withhold 7 percent for state income tax. This applies to winnings. This breakdown will include how much income tax you are paying, state taxes. But several states run similar programs, including california,. — especially since state taxes come into play if you are in a state that taxes lottery winnings. Winning mega millions or powerball lottery. 2 дня назад — money won in raffles is subject to state and federal tax. “a person receiving gambling winnings must furnish the exempt organization a. § 43-405 extension of withholding to gambling winnings. California is different from federal tax law in many ways, meaning that your federal deductions do not necessarily apply. Gambling losses are deductible,. — if you are lucky enough to win when you go to the casino, you will not necessarily have to report the winnings on your tax returns. Department of the treasury — internal revenue service. 4 federal income tax withheld